Amazon AWS 开始代收加拿大的货劳税

作者:

最后更新于 | 最初发布于 | 分类: 服务器和主机

Amazon 的 email 通知:

Greetings from Amazon Web Services,

Amazon Web Services, Inc. ("AWS") will charge Canadian transaction taxes, such as Goods and Services Tax ("GST"), Harmonized Sales Tax ("HST"), and Quebec Sales Tax ("QST"), on your use of the Canadian data center and Canadian CloudFront sites beginning December 2016. Provincial tax rates apply based on your billing address.

You will receive both a commercial invoice for payment and a tax invoice through your AWS billing console. The tax invoice will separately state the specific transaction taxes charged. If you are registered for GST/HST or QST, you may be eligible for input tax credits and utilize the tax invoice to support the input tax claim. For additional details, please visit the Canada Revenue Agency and Revenu Québec websites at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/bspsbch/itc-cti/menu-eng.html and http://www.revenuquebec.ca/en/entreprises/taxes/tpstvhtvq/ctirti/default.aspx, respectively.

Thank you for using Amazon Web Services.

Sincerely,

Amazon Web Services, Inc.

Amazon Web Services, Inc. is a subsidiary of Amazon.com, Inc. Amazon.com is a registered trademark of Amazon.com, Inc. This message was produced and distributed by Amazon Web Services Inc., 410 Terry Ave. North, Seattle, WA 98109-5210

如果在用CloudFront的时候,有选择加拿大的数据中心,那就会被收取这个"货劳税",我们通常称之为 GST,或者 HST ,QST,因为各个省份有所差异,名称也就有所不同,税率也略有不同。

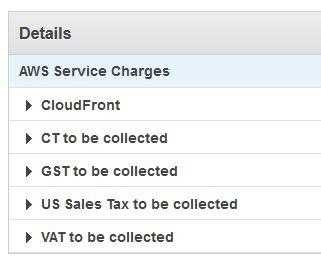

我的 AWS 账单部分,可以看到 CloudFront 收费,GST就是加拿大的税, US Sales Tax 就是美国的税,VAT 就是欧盟的增值税,CT 是日本的消费税。因为 AWS 的服务在全球各地都有的数据中心,有服务器,通常就是你使用了在哪里的数据中心,就会被应用于该地的税收。

2017年开始,AWS 加拿大的货劳税开始收取了。

评论